If you’re a homeowner in Texas—especially anywhere near Austin—there’s a storm brewing over your roof, and it has nothing to do with the weather.

In 2025, a silent shift in the insurance industry is rewriting the rules on what’s covered, how much you’ll get paid, and who’s left footing the bill when your roof takes a hit. And for many homeowners, the answer is you.

Whether you’re searching for reliable roof replacement companies, considering your next policy renewal, or simply trying to protect your most valuable asset—your home—this is the one article you cannot afford to ignore.

The Hidden Crisis: Your Roof May No Longer Be Covered Like You Think

Until recently, most homeowners could count on their insurance policy to cover a roof replacement if damage occurred. That’s changing—and fast.

Insurance carriers are shifting away from Replacement Cost Value (RCV) policies (which pay for full roof replacement) toward Actual Cash Value (ACV) policies, which pay only for the depreciated value of your existing roof. That means if your roof is 15 years old, you may only get paid pennies on the dollar—or nothing at all.

This isn’t theory. This is happening right now, in cities across Texas.

According to Verisk’s 2025 report, roof claim costs skyrocketed to $31 billion in 2024—up 30% since 2022. To curb losses, insurers are rewriting coverage rules, and homeowners are the ones paying the price.

Why Roof Replacement Companies Are Now the First Line of Defense

This seismic insurance shift means that working with qualified, reputable roof replacement companies isn’t just a convenience—it’s your best protection against financial disaster.

Good roofing contractors aren’t just installers anymore. They’re consultants. Advocates. Educators.

Especially in high-risk zones like Central Texas, where hailstorms are frequent and deductibles are climbing, the right contractor can:

Evaluate storm damage accurately

Help you understand your policy language

Guide you through the supplement and claims process

Recommend roofing systems that may qualify for premium discounts

Offer legal, transparent financing options to close the funding gap

But not all companies are equipped for this. In fact, most aren’t.

The market is dividing. Low-budget, storm-chasing crews are cutting corners and disappearing before warranty issues surface. Meanwhile, trusted Austin roofing contractors and professional roof replacement companies are adapting with better service, policy literacy, and high-integrity communication.

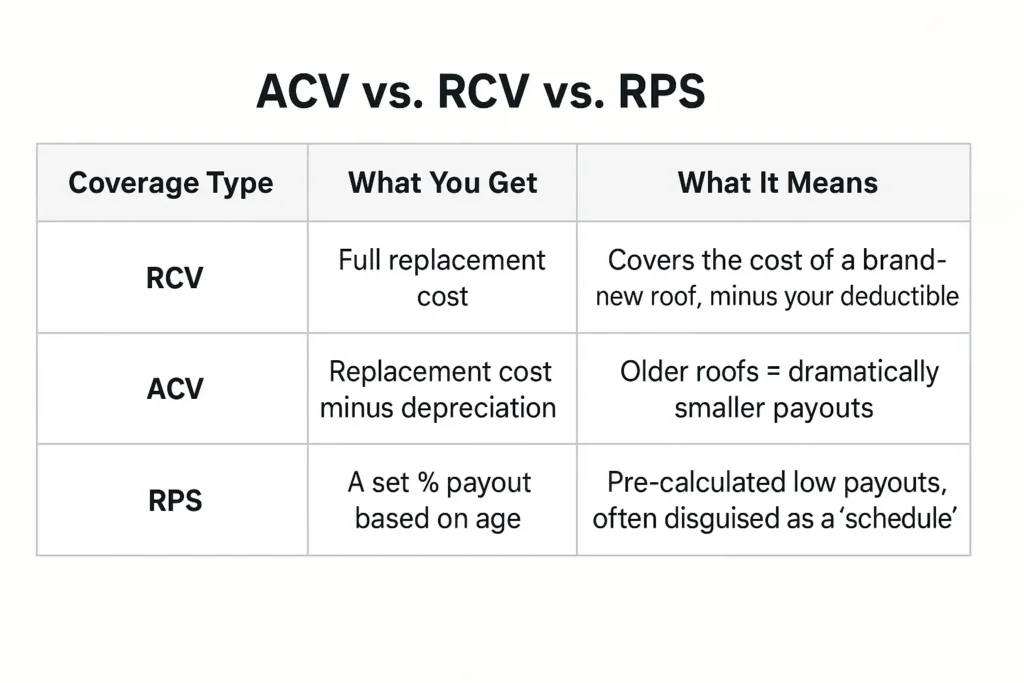

ACV vs. RCV: The Fine Print That Could Cost You Everything

If you’re comparing roof replacement companies, you need to know one thing before anything else:

What kind of insurance policy do you actually have?

Most homeowners assume that if a storm damages their roof, insurance will cover it. But as of 2025, that assumption could leave you holding the entire bill.

The Texas Department of Insurance confirms the shift from RCV to ACV is well underway.

An RPS, or Roof Payment Schedule, often hides behind friendly-sounding language while functioning almost identically to ACV. These tiered depreciation models reduce your reimbursement based on the roof’s age—meaning many homeowners receive little to nothing.

And with percentage-based deductibles now common across Texas, most policies include a 2% or even 3% wind/hail deductible based on the home’s insured value. That’s $8,000–$12,000 out-of-pocket on a $400,000 home—before your insurer contributes a dollar.

The Shift from RCV to ACV Is Happening Now

Traditionally, policies were written under Replacement Cost Value (RCV). That meant insurance would pay to fully replace your roof with similar materials—no matter how old it was—minus your deductible. It was straightforward. Predictable. Reliable.

But now, insurers across Texas and the U.S. are moving to Actual Cash Value (ACV)—especially when your roof is over 10 years old.

Here’s the difference:

This is the new normal for homeowners in Texas.

The Roof Payment Schedule (RPS): A Trojan Horse for ACV

Insurers are now using a new tactic called a Roof Payment Schedule (RPS). It sounds like a benefit. It’s not.

An RPS isn’t a new form of coverage—it’s just ACV with a prettier name. It sets fixed percentages of how much your insurer will pay based on the roof’s age.

Here’s a common RPS breakdown:

0–5 years old: 100% coverage

6–10 years: 80%

11–15 years: 60%

16–20 years: 40%

21+ years: 20%

Now ask yourself: how old is your roof?

If it’s more than 10 years old, your insurance may only cover half or less of a full replacement. And again, that’s before the deductible.

Percentage-Based Deductibles: The Second Gut Punch

We’re not just talking about lower payouts. Homeowners are also getting hit with bigger deductibles.

Instead of a flat $1,000 deductible, most new policies in Texas have percentage-based wind and hail deductibles—commonly 2% or more.

If your home is insured for $400,000:

A 2% deductible = $8,000

A 3% deductible = $12,000

So now you’re dealing with:

Smaller insurance checks (due to ACV)

Larger deductibles (percentage-based)

Aging roofs (38% of U.S. roofs are in moderate to poor condition)

The result? Millions of Texas homeowners could be left with $15,000–$25,000 in out-of-pocket roof replacement costs.

This is why working with the right roof replacement companies has never mattered more.

Real Talk: ACV Coverage May Leave You With Nothing

One of the most important charts from the research report says it all:

| Scenario | Roof Cost | Roof Age | Policy Type | Deductible | Insurance Pays | You Pay |

|---|---|---|---|---|---|---|

| Ideal RCV | $20,000 | 5 years | RCV | $1,000 | $19,000 | $1,000 |

| Modern RCV | $20,000 | 12 years | RCV | $8,000 | $12,000 | $8,000 |

| ACV | $20,000 | 15 years | ACV | $8,000 | $0 | $20,000 |

| RPS | $20,000 | 18 years | RPS (40%) | $8,000 | $0 | $20,000 |

The trend is clear: the older your roof, the more you pay—and the less you get.

Why It Matters Now, More Than Ever

Here in Central Texas, storm activity isn’t slowing down. In fact:

Severe convective storm losses hit $60 billion in 2023

Hail damage alone costs U.S. insurers $10+ billion annually

Texas is a hotspot for these claims

That’s why every Austin roofing contractor and homeowner needs to get proactive—fast.

When Insurance Fails: The Real Cost to Homeowners

As confirmed by the U.S. Treasury, policy non-renewals are skyrocketing in climate-vulnerable areas. And homeowners left uninsured are forced into state-managed last-resort programs, like the Texas FAIR Plan—which offer less coverage at a higher cost.

Combine this with the fact that 38% of U.S. roofs are in moderate to poor condition, and you’ve got a recipe for disaster.

The Out-of-Pocket Reality: Insurance That Pays $0

We already broke down the math earlier, but let’s bring it home again with a real-world example. This isn’t scare tactics—this is what homeowners are actually experiencing.

Let’s say you live in a modest home in Austin worth $400,000.

A hailstorm rolls through and destroys your roof.

You think, “I’m covered.”

But here’s what your insurance really gives you:

Roof replacement cost: $20,000

Roof age: 15 years (75% depreciated)

ACV payout: $5,000

Wind/hail deductible (2%): $8,000

Final insurance payout: $0

You’re left holding a $20,000 bill.

That’s not just a repair problem. That’s a vacation fund. That’s a college tuition payment. That’s someone’s retirement timeline getting delayed by 5 years.

And it’s not rare.

The report found that 29% of U.S. asphalt roofs have less than 4 years of useful life left, and 38% of all roofs are already in moderate to poor condition. That’s tens of millions of homeowners sitting in vulnerable homes with policies that won’t help when disaster hits.

Shrinking Coverage. Rising Premiums. And a Broken Safety Net.

Even worse? Many homeowners are losing their coverage entirely.

The U.S. Treasury confirmed that policy non-renewal rates are 80% higher in high-risk ZIP codes, especially in storm-prone regions like Central Texas. Some insurance companies are outright refusing to write new policies for older homes—especially those with older roofs.

And those who are dropped? They’re forced into the state’s “last resort” coverage: Texas FAIR Plan Association policies. These plans are:

More expensive

Less comprehensive

Rapidly filling up

In 2023 alone, over 1.1 million Texas households—1 in 6—lived without property insurance.

That number is expected to grow.

How It Impacts the Housing Market

These insurance changes don’t just affect roof replacement. They’re impacting the entire real estate market.

Buyers are backing out of deals when they see insurance quotes

Sellers are discounting their homes if the roof is old and uninsurable

Older homeowners on fixed incomes are being forced to sell

Property values in storm-prone ZIP codes are stagnating or declining

Generational wealth is being lost—one roof at a time

There’s even a brewing crisis between mortgage lenders and insurers. Fannie Mae and Freddie Mac require properties to have RCV coverage… but insurers are replacing RCV with ACV at renewal, which technically puts those loans in violation.

This could lead to mass defaults in the event of another major storm—and even bigger problems for the housing economy.

What Homeowners Can Do Right Now

This may sound bleak, but here’s the good news: you’re not powerless.

There are clear, actionable steps you can take today to avoid being blindsided later.

Get Your Policy in Front of a Professional

Ask your agent the hard questions:Is my roof covered under RCV or ACV?

Do I have a Roof Payment Schedule?

What’s my wind/hail deductible, exactly?

Can I buy back RCV coverage?

Get Your Roof Professionally Inspected

A professional inspection from a licensed Austin roofing contractor can:Document current roof condition (helps with future claims)

Spot wear and tear that might lead to a denied claim

Give you insight into how much life your roof has left

Plan for the Worst Now—Before It Costs You

If your roof is over 10 years old, it’s time to start planning:Consider upgrading to Class 4 shingles or impact-resistant materials

Ask your roofer about available financing options

Start a home maintenance fund to prepare for a potential $10k+ expense

The days of relying on your insurance to cover everything are over.

You’re not just a policyholder anymore. You’re a risk manager.

Roofing Companies Are No Longer Just Builders—They’re Financial Lifelines

Ten years ago, hiring a roofer was simple. You got a few quotes, picked the lowest bid, and let your insurance company handle the rest.

In 2025? That mindset could cost you everything.

The game has changed. Insurance isn’t what it used to be, and the role of roof replacement companies has evolved with it. The best ones are no longer just installers—they’re educators, advocates, and legal guides through a minefield of confusing policies and dangerous gray areas.

What Makes a Modern Roofing Contractor Different?

If your roof is storm-damaged, you’re not just dealing with shingles and nails anymore. You’re navigating:

Complex insurance jargon (ACV vs. RCV, RPS, deductible calculations)

High out-of-pocket expenses

Claims adjusters who might minimize damage

Texas laws that make it illegal for a contractor to cover your deductible

A trusted roofing contractor in Texas needs to be fluent in:

Local and state insurance laws (like Texas Insurance Code § 707.004)

The supplement process (getting insurers to pay for code upgrades, hidden damage, etc.)

Adjuster meetings (fighting to get full scope covered)

Transparent, legal financing (for covering high deductibles without breaking the law)

And if your contractor doesn’t know how to do that?

You’re on your own—with a massive invoice in your lap.

The Danger of “Deductible Eaters” and Storm-Chasers

One of the most common scams in Texas roofing involves shady contractors offering to “waive” or “absorb” your deductible.

🚨 It’s illegal.

🚨 It’s insurance fraud.

🚨 It puts you at risk—financially and legally.

Under Texas law, both the contractor and the homeowner can face serious penalties. These companies cut corners to make up the loss and usually disappear before warranty issues show up.

So how do you protect yourself?

What to Look for in a Roofing Contractor (Texas Edition)

Here’s a checklist for hiring roof replacement companies that are actually prepared for this new era of insurance:

✅ Licensed and insured (ask for proof)

✅ Understands ACV/RCV/RPS and can explain your policy

✅ Won’t touch your deductible or offer shady deals

✅ Offers legal financing options to help cover out-of-pocket gaps

✅ Educates you about your policy, not just pushes a contract

✅ Documents all damage thoroughly (photo + video evidence)

✅ Meets the adjuster onsite to advocate for proper scope

✅ Provides Good-Better-Best options for roofing systems

✅ Stands behind their work with real warranties (not fake “lifetime” ones)

If they can’t check these boxes? Walk away.

Especially in Central Texas, where weather swings violently and policies are increasingly strict, working with a trusted Austin roofing contractor is the difference between being protected—and being broke.

Why Roof Replacement Companies Are Now the First Call After a Storm

Back in the day, your first call after a storm was to your insurance agent.

Today? That’s backward.

You need to call a qualified roofer before filing a claim. Why?

Because:

They can inspect the damage objectively

They’ll document everything in a way that supports your claim

They can tell you if it’s worth filing, or if the deductible/ACV math makes it pointless

They’ll help navigate the process step-by-step

They’ll make sure you don’t accept a lowball offer from an adjuster

A good roofing company can save you thousands—not by cutting costs, but by maximizing your value and protecting you from devastating surprises.

The 2025 Roofing Reality: What Homeowners in Texas Must Do Today

By now, the facts are clear:

Insurance coverage is shrinking.

Out-of-pocket costs are exploding.

More homeowners are finding themselves completely uninsured or dangerously underinsured.

And aging roofs—especially in Texas—are ground zero for this financial disaster.

This isn’t some future risk. It’s already here.

If you’re a homeowner looking for roof replacement companies, or you’ve been putting off getting your roof looked at, now is the time to act.

Because waiting could cost you tens of thousands of dollars.

Your 5-Step Roofing Action Plan (Based on the Latest Data)

Let’s keep this simple. Here’s what every smart homeowner should do right now:

1. Review Your Insurance Policy — Don’t Assume Anything

Open up your declarations page and look specifically for:

ACV vs. RCV coverage

Roof Payment Schedule (RPS) clauses

Wind/hail deductible amount (in dollars and percentage)

Exclusions for “wear and tear” or “neglect”

Still not sure what you’re looking at? A qualified roofing contractor in Texas can help walk you through it.

2. Get a Free Roof Inspection from a Local Expert

Don’t wait until water is dripping through the ceiling. Have a professional, like an Austin roofing contractor, do a full inspection and report:

Your roof’s current condition

Any signs of wear, damage, or material breakdown

Photo and video documentation to support future claims

This creates a paper trail that can be critical if you ever need to fight for coverage.

3. Invest in Resilient Materials

If your roof is nearing the 10–15 year mark, it may be time to replace it before disaster strikes.

Upgrading to:

Class 4 impact-resistant shingles

Metal roofing

FORTIFIED roofing standards

…can reduce future damage and even qualify you for premium discounts.

Many roof replacement companies now offer “Good-Better-Best” packages, giving you options for every budget and risk level.

4. Plan for the Financial Gap

ACV policies and high deductibles mean you’re likely to pay $10,000–$20,000 out of pocket when a storm hits. That’s not speculation. It’s backed by data:

2% deductible on a $400,000 home = $8,000

Depreciation on a 15-year-old roof = 75% loss of value

Insurance payout: $0.

Total cost to you: $20,000

Start saving now—or ask your roofer about legal financing that can help cover that gap without risking fraud.

5. Choose Your Roofing Partner Wisely

Not all contractors are prepared for this new era.

Avoid fly-by-night storm chasers. Stay far away from anyone who promises to waive your deductible.

Look for:

Strong reviews

Texas license and insurance

Experience handling ACV claims

Clear communication and documentation

Financing options and educational approach

Top roof replacement companies will make your life easier—not riskier.

Final Thoughts: Adapt or Get Burned

Roofing isn’t just about shingles anymore. It’s about protecting your financial future. The insurance industry is shifting risk back onto the homeowner, and unless you’re proactive about your roof, your policy, and your plan—you’re gambling with everything.

If you live in Central Texas and haven’t had your roof inspected this year, do it now.

Don’t wait until your insurance company says, “We don’t cover that anymore.”

Book a free inspection. Know your roof. Know your policy. And choose a partner who actually knows how to navigate this.

This is the new roofing reality. The question is—are you ready for it?

Homeowners across Central Texas—especially those looking for Austin roof repair or comparing roof replacement companies—need to act before the next storm rolls through.

Frequently Asked Questions (FAQ)

Q: What is the difference between ACV and RCV roof coverage?

A: Replacement Cost Value (RCV) covers the full cost to replace your roof minus your deductible. Actual Cash Value (ACV) subtracts depreciation based on the roof’s age and condition, often leaving you with much higher out-of-pocket costs.

Q: What is a Roof Payment Schedule (RPS)?

A: An RPS is a structured version of ACV that pays out a pre-set percentage of your roof’s replacement cost based on its age. It’s commonly used for older roofs and often results in very low payouts.

Q: How can I find out what type of policy I have?

A: Check your declarations page or call your insurance agent. Look for terms like “Actual Cash Value,” “Roof Payment Schedule,” or “Replacement Cost Coverage.”

Q: How much is my deductible likely to be?

A: Most Texas homeowners now carry a 2% or higher wind/hail deductible. For a $400,000 home, that means you could pay $8,000 or more before insurance kicks in.

Q: Can a roofer legally waive my deductible?

A: No. Under Texas law, it is illegal for any contractor to waive, absorb, or refund your deductible. Doing so is considered insurance fraud.

Q: What’s the best way to prepare for a roof replacement financially?

A: Review your policy, schedule a roof inspection, and speak with a roofer about financing options. If your coverage is ACV or RPS, expect to fund a large portion of the replacement yourself.

Q: Is a free roof inspection really free?

A: Yes—reputable roofing contractors offer inspections at no charge to assess your roof’s condition, provide photo documentation, and help you understand your risk exposure.

Get Started Today

📍 If you’re in Austin or anywhere in Central Texas and haven’t had your roof inspected in the last 12 months… now’s the time.

Tap below to schedule a free inspection from a trusted Austin roofing contractor and get clarity on:

What your roof needs

What your policy covers

And what your next steps should be

Don’t wait until a $0 insurance payout turns into a $20,000 mistake.